I wanted to start with initially was: “we all know resistance turns into support” but then I thought 'oh wait that is wrong, everybody does not know that'. Even though it might be new concepts to some of you this is not exactly what I will discuss today but it has a lot to do with it. Today's discussion or paper how ever you chose to see it, is about how I interpret the force in the bars on the chart when this happens.

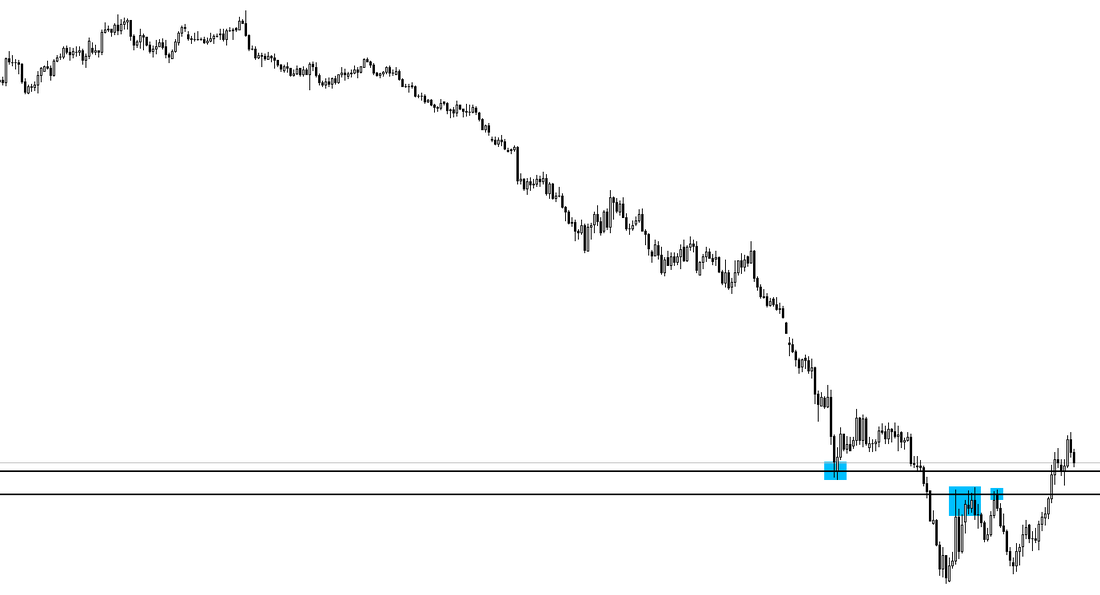

So when what happens exactly? And can I be a little bit more vague? Yes I can but i'm not quite sure how to get this one started. This weeks story started with a discussion on a forum about a situation in the Eur/Usd chart. Here is an overview of the Euro, we can see that it has been going down for quite a while now.

So when what happens exactly? And can I be a little bit more vague? Yes I can but i'm not quite sure how to get this one started. This weeks story started with a discussion on a forum about a situation in the Eur/Usd chart. Here is an overview of the Euro, we can see that it has been going down for quite a while now.

The basics

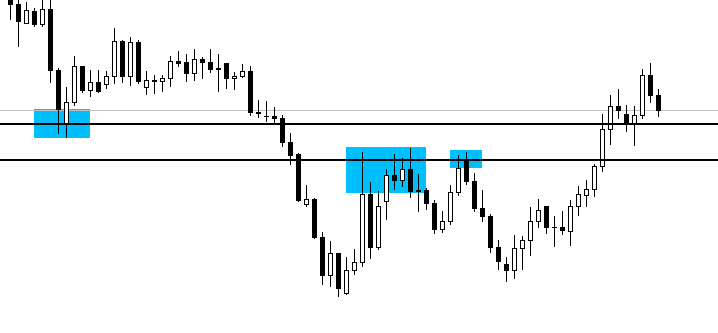

So the basic version is this, once a level is closed beyond the idea is that this level then is broken but can be used in reverse. For example if the ceiling level, resistance, is broken and closed beyond it is then thought that the old ceiling level is some sort of level that is no longer valid. The old ceiling was conquered in force but that does not mean that it is worthless, according to the idea. It means that price can no longer remain below the previously significant level but now is above it and if that is true it should also be true that price should not want to go down and/or close below the previous level. Hence the term “previous resistance turned support”, in the example this level is now refereed to as support. That is all ofc if the level was and is significant though.. read on.

In the image below I've drawn two lines as to show where the resistance was, several times. Remember that no one line or level is true but a resistance whether support or resistance often is an area. That is what i show here with the two lines, between the two of them we have some sort of an area.

The Nison link

What I thought of though was something that Steve Nison talks about where if the price closed beyond the level there is a way to trade this using the actual bar that did this. In my interpretation, and please understand that i am speculating here, the low of the bar and/or the low of the recent swing should be support. In this case I am thinking of the low of the bar though and how a breakout over the level triggered a pending on stop long order. That is the start of it. The second part is how and why the stops where moved and adjusted, each bar considered at each step. Yes I know I might be overdoing it but I am just crazy like that.

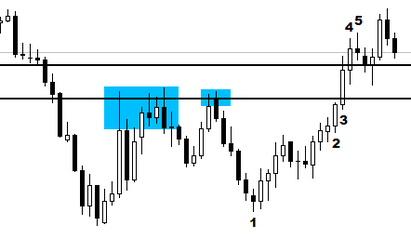

Here is yet again the same picture but now with some numbers added.

What I thought of though was something that Steve Nison talks about where if the price closed beyond the level there is a way to trade this using the actual bar that did this. In my interpretation, and please understand that i am speculating here, the low of the bar and/or the low of the recent swing should be support. In this case I am thinking of the low of the bar though and how a breakout over the level triggered a pending on stop long order. That is the start of it. The second part is how and why the stops where moved and adjusted, each bar considered at each step. Yes I know I might be overdoing it but I am just crazy like that.

Here is yet again the same picture but now with some numbers added.

So lets go through some of the numbers. 1 is the point where price recently did not want to go any further down and as such I claim that is the swing point. 2 is the bar where the stop loss would be on a pending break order, more on this later. 3 is the bar that activated the pending order. 4 is the next bar with the close above the area. 5 is a doji bar and etc..

Now then as for the pending long order, it would be triggered by the bar 3 but the stop would be below 2, since that's the place where it would have to be. Remember we do not know the future the stop has to be one bar back since the stop cannot be below the actual bar breaking the level but the previously known and closed bar.

But what happens after that? Well basically the 3'rd bar is the one that turns it all upside down so now we have an order but it is still not safe. There is a stop down there but when do we adjust it and why? The 4th bar is the one that proves we have even more power to go higher and after the 5th bar we appear to remain there. Now i could say that yes bar number 5 is a doji and because it displays equality above the previous area we might be at the new floor of a level and the 7th bar shows this, sure sure. But that in itself is no reason for me to move a stop though, why? What i would do really after the 5th bar has closed is to move the stop up and close some of the profits, so that we do not lose in the long run = being overall at a safe spot. The stop was moved not because of the magnitude of force in price, although that could be the case otherwise, but because price showed us that there was a lack of force by the doji.

So why is this important? Well that is a good question since i partly believe that there is no true answer to this. What i do think though is that if we "break the risk to reward" we will not be profitable and also if we "do not follow the force in price" we also will not be profitable. Those two rules are some of what we've done here, by not moving the stop until we have more force in price up versus down (by somewhat proven) while at the same time giving the order the possibility to gain in profit infinitely. It might take a long time, and yes i know this is a definition all in itself, but if we do the math on these things we should be good.

I know this was a lengthy one but i think this concept although simple is very important to understand. If price wants to remain above the level then the level being the floor should hold = we can trade of this and if not then we cannot. Every little extra piece of information is a tool that we as traders can use to become a little bit more profitable. To most the margin for error and profit is small and i think that if you master this then you will be one step closer to where you want to go.

But what happens after that? Well basically the 3'rd bar is the one that turns it all upside down so now we have an order but it is still not safe. There is a stop down there but when do we adjust it and why? The 4th bar is the one that proves we have even more power to go higher and after the 5th bar we appear to remain there. Now i could say that yes bar number 5 is a doji and because it displays equality above the previous area we might be at the new floor of a level and the 7th bar shows this, sure sure. But that in itself is no reason for me to move a stop though, why? What i would do really after the 5th bar has closed is to move the stop up and close some of the profits, so that we do not lose in the long run = being overall at a safe spot. The stop was moved not because of the magnitude of force in price, although that could be the case otherwise, but because price showed us that there was a lack of force by the doji.

So why is this important? Well that is a good question since i partly believe that there is no true answer to this. What i do think though is that if we "break the risk to reward" we will not be profitable and also if we "do not follow the force in price" we also will not be profitable. Those two rules are some of what we've done here, by not moving the stop until we have more force in price up versus down (by somewhat proven) while at the same time giving the order the possibility to gain in profit infinitely. It might take a long time, and yes i know this is a definition all in itself, but if we do the math on these things we should be good.

I know this was a lengthy one but i think this concept although simple is very important to understand. If price wants to remain above the level then the level being the floor should hold = we can trade of this and if not then we cannot. Every little extra piece of information is a tool that we as traders can use to become a little bit more profitable. To most the margin for error and profit is small and i think that if you master this then you will be one step closer to where you want to go.

RSS Feed

RSS Feed