Intro

So what is it? Many people ask me, hey Alex what about that Pamm account how come it does this and that? What is it all about really. I get these questions often, not every day but every other day. With the many interactions i have and people i talk to they are usually skeptic about what I do but they do see my results clear as day and the start asking questions. So I thought i'd write this article to explain some basics for them.

Definitions

For reference the strategy I use in my trading this account is the Tatsumaki Symbiosis strategy which is explained here: http://forum.mt5.com/showthread.php?105910-Symbiosis-strategy and the account that is traded with it, called “the Pamm”, is the one in this thread: http://forum.mt5.com/showthread.php?117985-8268081-Tatsumaki-Pamm this is all done via the guys at: https://www.instaforex.com/ so if you are also there, like me, consider looking into this.

The Basics

Now that we have gotten that out of the way I can start to talk more freely about this. So what is this so called strategy, is it a clear set of rules for how I should trade? Well yes in a way it is, also it is not. Here is why. While there are clear rules for what should be done in the strategy for example “only buy when x is y” that does not mean that the strategy is 100% automatic. That is something a machine can do but what would be harder for a machine to do is look at the market and decide that “right now I will place my stop order here and not there because I have z amount and the risk is w in my account”. There are rules for when trades should be taken but because there is a human doing the trading, namely me, things tend to be thought out a bit. Another example is when the market has been going slow but there is a lot of decent profit for the week I might consider not being as aggressive with the trades as the system denotes it should be, simply because that is not needed.

The trading done uses hedging, that means that position on the market that is not profitable is of-set by another position (here on the same currency pair), thus leaving me with the total risk the difference of the two. The idea then is that when one position is in profit, there are rules for when and by how much, the profitable position is locked in with a stop loss order and an additional order in the same direction is added to the chart. This addition is another pending buy/sell stop order as the one locked in but is simply further away from the price. This is where PA comes into play, that and some maths.

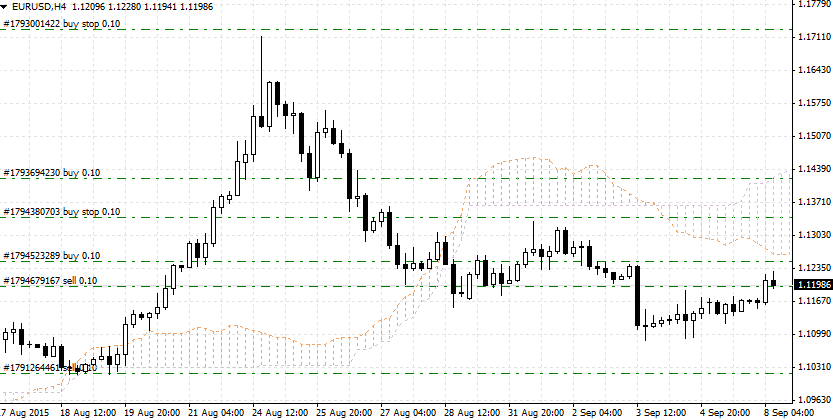

Here is an example:

Look at how there are some positions on the chart some are filled and some are pending orders. Those pending orders are there to of-sett the difference of the filled ones so that they all together, if filled, would create a as close as possible to complete balance meaning zero risk. The amount risked on the table then is only the distance to the pending orders. The game is moving the orders to places where they would make sense on the chart and later locking the profits in. An example is where the pending buy stop orders are placed above the recent peak, if we go there i'd like to be long but also i'd like to equalize. And if we do not go there but go down then I am in a profitable position because of all the other orders that are live that I later can move my pending orders lower, thus enabling an even better total place of standing.

And that it how it is done. Price goes up and down, sometimes it pauses for a while and sometimes my stops are taken out with only a little profit. But slowly the balancing makes the account grow, if but slowly. Ofc there are many other numbers and factors to it all but that is the gist of it.

So what is it? Many people ask me, hey Alex what about that Pamm account how come it does this and that? What is it all about really. I get these questions often, not every day but every other day. With the many interactions i have and people i talk to they are usually skeptic about what I do but they do see my results clear as day and the start asking questions. So I thought i'd write this article to explain some basics for them.

Definitions

For reference the strategy I use in my trading this account is the Tatsumaki Symbiosis strategy which is explained here: http://forum.mt5.com/showthread.php?105910-Symbiosis-strategy and the account that is traded with it, called “the Pamm”, is the one in this thread: http://forum.mt5.com/showthread.php?117985-8268081-Tatsumaki-Pamm this is all done via the guys at: https://www.instaforex.com/ so if you are also there, like me, consider looking into this.

The Basics

Now that we have gotten that out of the way I can start to talk more freely about this. So what is this so called strategy, is it a clear set of rules for how I should trade? Well yes in a way it is, also it is not. Here is why. While there are clear rules for what should be done in the strategy for example “only buy when x is y” that does not mean that the strategy is 100% automatic. That is something a machine can do but what would be harder for a machine to do is look at the market and decide that “right now I will place my stop order here and not there because I have z amount and the risk is w in my account”. There are rules for when trades should be taken but because there is a human doing the trading, namely me, things tend to be thought out a bit. Another example is when the market has been going slow but there is a lot of decent profit for the week I might consider not being as aggressive with the trades as the system denotes it should be, simply because that is not needed.

The trading done uses hedging, that means that position on the market that is not profitable is of-set by another position (here on the same currency pair), thus leaving me with the total risk the difference of the two. The idea then is that when one position is in profit, there are rules for when and by how much, the profitable position is locked in with a stop loss order and an additional order in the same direction is added to the chart. This addition is another pending buy/sell stop order as the one locked in but is simply further away from the price. This is where PA comes into play, that and some maths.

Here is an example:

Look at how there are some positions on the chart some are filled and some are pending orders. Those pending orders are there to of-sett the difference of the filled ones so that they all together, if filled, would create a as close as possible to complete balance meaning zero risk. The amount risked on the table then is only the distance to the pending orders. The game is moving the orders to places where they would make sense on the chart and later locking the profits in. An example is where the pending buy stop orders are placed above the recent peak, if we go there i'd like to be long but also i'd like to equalize. And if we do not go there but go down then I am in a profitable position because of all the other orders that are live that I later can move my pending orders lower, thus enabling an even better total place of standing.

And that it how it is done. Price goes up and down, sometimes it pauses for a while and sometimes my stops are taken out with only a little profit. But slowly the balancing makes the account grow, if but slowly. Ofc there are many other numbers and factors to it all but that is the gist of it.

RSS Feed

RSS Feed