Why does price move?

To start with i have to say that i think i have been over this subject so many times that my keyboard must soon be bored with me. Then why is it that i have to write this yet again? Well i read daily statements of junior traders claiming this and that of how price moves and why when in reality there are completely different things that determines the moves in the market.

Levels

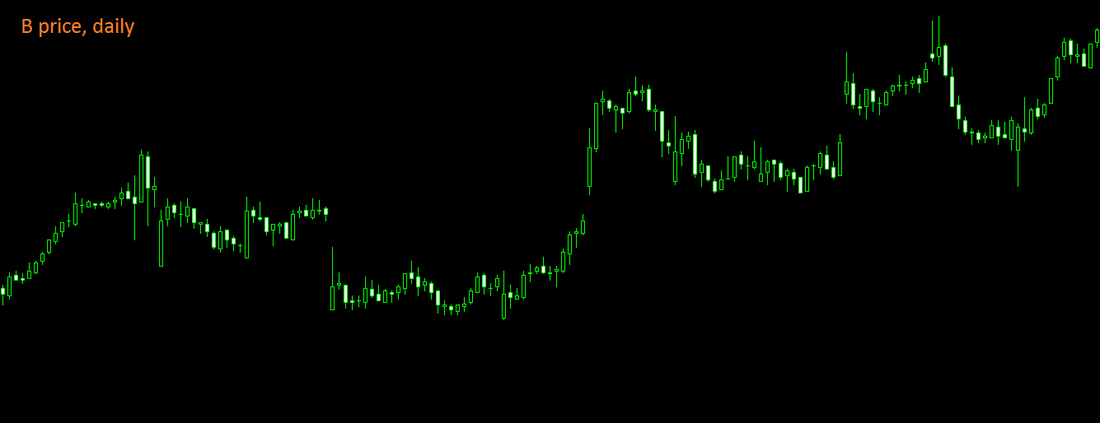

So what are levels? What is a level really? Well think of it this way if the entire population of traders where all monkeys and they had to eat bananas every day, lets also say that they had to buy a certain amount because there is a fixed number of traders. In this example this number is static, lets assume that they do not increase nor decrease in number. What would happen each and every day because of seasons is that sometimes the price of a banana is cheaper then on other days and the smart monkeys would start to buy more on those days, remember they can only buy 1 weeks worth or so because they go bad after that. This creates some small fluctuations in price because of these factors and we can start to see waves in price. It might look something like this:

As you can see the price of bananas are low some days and it is also high some days. But why? Why does the high price stop right there? The answer is twofold, initially we do not know why it stops but after that we might have a clue. For example the high price of bananas during a period could mean that it could only rise “so much” until the monkeys stop buying it. Why some are smarter the others and buy a lot when the price is low and a few would still buy each and every day. Eventually though as more and more understand how this fluctuates the previous high/low levels change and something begins to happen.

It looks like on the image that we are starting a long trend. This might be, but why? Well why does not matter really. Though it could be that during a period the production of bananas is more difficult I am thinking of for example the weather or temperature, these are two factors that impact it.

What we notice is that even though the price fluctuates it appears to rise. The monkeys need to eat remember, in this example we are using a static demand model and they need to buy some each day. While the smart monkeys will be quick to realize what the low price is and buy there the rest will continue to buy each day. Although in the back of their minds they remember “hey I know I could buy 2 kg bananas for $10” that also affects them, am I right?

Think about this example and see if you can find something similar that happened to you in real life. I am sure that you can think of something and remember that price will go up because more people will buy then sell and price will stop going up when less people want to buy then sell. The factors can be many, how much is available is one factor and the price is another.

How to use this in trading?

So how do you actually use this information in your trading? It is not that difficult to make out, to me at least. You buy low sell high, that is the end of explaining right?? ;) no.. I am just making a joke. It is not that simple, but we can look at a chart and think to ourselves “here price stopped going up” and mark that then we can look at the same chart and say “from where did this high price come ultimately?” and mark that. What we have done is we have determined from where to where price went, one cycle and we can use that information to later decide if we want to get in again. If the market is the same still, consensus and fundamentals, then should it not be logical that we can buy at the same low yet again? Though anything can happen.

What if we bought at the recent low and price keeps on going lower and creates yet another low. What does that tell us? Well it tells us that there is something off in the market and the price of, say bananas, became cheaper for some reason. Maybe there was an excess surplus introduced into the market or something like that. Remember if there is more available of a good or service the need to purchase it right then and there is not as great for what ever reason.

So now the process starts over again we have a new low and should we buy there? Maybe the next time price comes there right? And we might be correct that time and we sell our bananas higher. It keeps on repeating like that. Sometimes we are correct and other times we are not and we need other methods to deal what that.

If you like what I do and you are on either etoro or instaforex, consider looking into my pamm or managed account services. Why should you have to do all the hard work when somebody else can do it for you? The number on instaforex is 8268081 and on etoro I go by AlexTatsumaki. See you there and have a good day.

To start with i have to say that i think i have been over this subject so many times that my keyboard must soon be bored with me. Then why is it that i have to write this yet again? Well i read daily statements of junior traders claiming this and that of how price moves and why when in reality there are completely different things that determines the moves in the market.

Levels

So what are levels? What is a level really? Well think of it this way if the entire population of traders where all monkeys and they had to eat bananas every day, lets also say that they had to buy a certain amount because there is a fixed number of traders. In this example this number is static, lets assume that they do not increase nor decrease in number. What would happen each and every day because of seasons is that sometimes the price of a banana is cheaper then on other days and the smart monkeys would start to buy more on those days, remember they can only buy 1 weeks worth or so because they go bad after that. This creates some small fluctuations in price because of these factors and we can start to see waves in price. It might look something like this:

As you can see the price of bananas are low some days and it is also high some days. But why? Why does the high price stop right there? The answer is twofold, initially we do not know why it stops but after that we might have a clue. For example the high price of bananas during a period could mean that it could only rise “so much” until the monkeys stop buying it. Why some are smarter the others and buy a lot when the price is low and a few would still buy each and every day. Eventually though as more and more understand how this fluctuates the previous high/low levels change and something begins to happen.

It looks like on the image that we are starting a long trend. This might be, but why? Well why does not matter really. Though it could be that during a period the production of bananas is more difficult I am thinking of for example the weather or temperature, these are two factors that impact it.

What we notice is that even though the price fluctuates it appears to rise. The monkeys need to eat remember, in this example we are using a static demand model and they need to buy some each day. While the smart monkeys will be quick to realize what the low price is and buy there the rest will continue to buy each day. Although in the back of their minds they remember “hey I know I could buy 2 kg bananas for $10” that also affects them, am I right?

Think about this example and see if you can find something similar that happened to you in real life. I am sure that you can think of something and remember that price will go up because more people will buy then sell and price will stop going up when less people want to buy then sell. The factors can be many, how much is available is one factor and the price is another.

How to use this in trading?

So how do you actually use this information in your trading? It is not that difficult to make out, to me at least. You buy low sell high, that is the end of explaining right?? ;) no.. I am just making a joke. It is not that simple, but we can look at a chart and think to ourselves “here price stopped going up” and mark that then we can look at the same chart and say “from where did this high price come ultimately?” and mark that. What we have done is we have determined from where to where price went, one cycle and we can use that information to later decide if we want to get in again. If the market is the same still, consensus and fundamentals, then should it not be logical that we can buy at the same low yet again? Though anything can happen.

What if we bought at the recent low and price keeps on going lower and creates yet another low. What does that tell us? Well it tells us that there is something off in the market and the price of, say bananas, became cheaper for some reason. Maybe there was an excess surplus introduced into the market or something like that. Remember if there is more available of a good or service the need to purchase it right then and there is not as great for what ever reason.

So now the process starts over again we have a new low and should we buy there? Maybe the next time price comes there right? And we might be correct that time and we sell our bananas higher. It keeps on repeating like that. Sometimes we are correct and other times we are not and we need other methods to deal what that.

If you like what I do and you are on either etoro or instaforex, consider looking into my pamm or managed account services. Why should you have to do all the hard work when somebody else can do it for you? The number on instaforex is 8268081 and on etoro I go by AlexTatsumaki. See you there and have a good day.

RSS Feed

RSS Feed